Gross Profit Explained Simply

What is Gross Profit?

Gross profit is the amount of revenue your business makes after subtracting all the costs required to make and sell its products or services.

It captures how much your business has sold (the revenue) and all the inputs, both variable and fixed, that go into making what it manufactures or provides.

In this article:

→ Gross profit summarised in 6 sentences

→ A simple gross profit formula (in $ and %)

→ The best way to calculate gross profit

→ Why is GP such is a crucial number?

→ The exact gross profit benchmark to aim for

→ Factors that influence gross profit

→ Questions to ask to increase your gross profit

In Short: Gross Profit

- Gross profit is calculated by subtracting the direct costs of goods sold, both variable and fixed, from revenue.

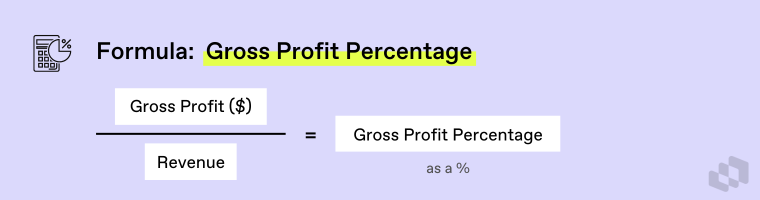

- The gross profit percentage is determined by dividing the gross profit dollars by the revenue.

- Fixed costs of goods sold often include direct labour and factory or warehousing costs.

- Gross profit is a crucial figure as it reflects the revenue and all inputs that go into delivering a product.

- The ideal gross profit benchmark is around 40%, although this can vary depending on the type of business.

- Factors that influence gross profit include price, product mix, labour efficiency, return on investment on space, and asset utilisation.

Gross Profit Explained Simply

“Gross profit is your revenue minus your direct costs of good sold (COGS).

That includes both your variable cost of good sold and your fixed cost of good sold.

Your gross profit percentage is the gross profit dollars divided by your revenue.

Your gross profit percentage is the gross profit dollars divided by your revenue.

The best formula experts use to work out GP & GP%

The formula you may have also seen is gross profit equals contribution margin minus fixed cost of goods sold. This is the way we look at it with our business and with our clients.

The next number down is looking at your gross profit, and the items that fill in the gaps between contribution margin and gross profit, are your fixed cost of goods sold.

→ Related: Contribution Margin & Gross Profit Explained

Your fixed cost of goods sold are most likely direct labour, potentially your factory or warehousing costs, where you keep your product or where you do your manufacturing or operations. This can include depreciation on any assets that are utilised in the income producing process, such as machinery or trucks that are used for delivery.

Why is GP such is a crucial number?

Gross profit is such an important number because it captures how much we've sold (the revenue) and all the inputs, both variable and fixed, that go into delivering our product, whether that's a tangible or intangible product.

The exact % GP benchmark you should be aiming for

The benchmark we should be aiming for in gross profit should be 40%. There are some anomalies to this.

For example, in a hire business (as in you rent assets), you're going to be asking for a lot higher gross profit than 40%. But if you’re running a manufacturing or a merchant style business (a buy-and-sell business), you ideally want to be aiming for your gross profit around about 40%.

Factors that influence both gross profit and contribution margin

The things that influence GP? If you look at what we spoke about in contribution margin; these are the things that also impact gross profit. It's our price, it's our product mix. It's how efficiently we utilise our materials.

Questions to ask yourself if you want to boost your gross profit

If I look down in the specific items around gross profit that are further to contribution margin, it's the efficiency of our labour:

- How well are they performing?

- How much income are they producing from the cost they incur?

- What is our return on investment around the space that we use?

Naturally, the better return on investment on our space, the better our gross profit is going to be and how well utilised are our assets. If we're able to use assets that are relatively low dollar value to produce high revenue, that's clearly a better outcome than having a very high asset intensive business, not getting an appropriate amount of revenue in return for that depreciation.

Learn everything we teach our clients... for free

Join 400+ business owners & leaders who receive practical business & accounting tips, delivered free to your inbox every week. No fluff, just high-level expertise. Sign up now.

.png?width=352&name=Yellow%20Black%20Modern%20Course%20YouTube%20Thumbnail%20(35).png)