Mastering the Effort-Output Equation for Greater Financial Success

In the evolving business landscape, sales teams have faced unique pressures in their environment.

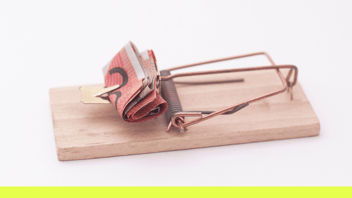

Historically, the most significant challenge for any business was winning work. Salespeople were like hunters, actively seeking and pursuing opportunities that generated leads and secured sales. The pressure was on them to bring home the bounty.

Shifting Business Pressures

In more recent years, a multitude of factors – including the pandemic and economy – shifted this paradigm. One of the biggest impacts to businesses was the supply chain disruption, worsened by natural disasters like floods and cyclones, where scarer supply caused significant price hikes to raw materials.

Consequently, any business that could still acquire its products - or the materials to manufacture its products - was ahead of the game. For those enterprises, the email enquiries and sales calls poured in; products and services practically sold themselves.

Sales teams transitioned from being hunters to gatherers, simply scooping up the plentiful rewards each quarter. This led to human resources becoming the department facing the most pressure, as they grappled with the challenge of finding and retaining good people cost-effectively.

The Resurgence of Sales

Now, the spotlight has shifted back to sales teams, re-establishing them as the linchpin of a successful business.

This perspective – coming from finance professionals, no less – highlights the critical role of salespeople. Without them, there are no sales, no products or services being produced, and no financial numbers to analyse. They’re vital, essentially, because they drive the entire business forward.

Key Takeaway: Global pressures in recent years turned many sales teams into gatherers, passively generating sales with little effort. Now they're required to be hunters again, actively involved in winning work.

Understanding Effort & Output

You might be wondering, what does all this have to do with the timeframe between effort and output? Let’s break it down.

Effort, in this context, involves engaging in highly productive marketing and sales activities. It’s about putting in the work. Output is when the invoice finally hits your profit and loss report, or when these efforts translate into invoiced profits.

To illustrate, consider your local pizza place. If you order a Meatlovers Deluxe at 6pm on a Friday night, in less than an hour the (hopefully) piping-hot pizza is at your doorstep. That’s a very small timeframe between the effort of the order being generated and the output of the sale. Effort to output = lightning fast.

Let’s swing to the other extreme, which is the biggest investment most of us will make in our lives: buying a house. A real estate agent might start the selling process for a new home up to 12 months before someone signs on the dotted line. Effort to output in this case? A snail’s pace.

Significance of the Effort-Output Relationship

So, why does this matter? Why should you care about the time between putting in the effort and seeing the output?

It’s all about your sales pipeline for the upcoming period, and how that aligns with your breakeven. How profitable will you be, if at all? And how quickly can you turn that around?

Remember, your sales team might have metaphorically had their feet on the desk, in the habit of leisurely awaiting orders. Now, they need to be ready for the battle of winning work again.

But if there’s a significant delay between putting in the effort versus when you get the output, you might find yourself in a prolonged period of financial struggle. This could look like not making a great deal of money, or even losing money as a result.

Decoding Your Landscape

To get clear on your current situation, here are some questions to ask.

- First, consider your sales pipeline. What does it look like currently?

- Second, what’s the timeframe between the effort and the actual output in your business?

- Finally, what could you do to potentially shrink that timeframe?

Take the example of an agent selling a house. They might not rush people through the selling cycle, but they can streamline the process by optimising their internal systems.

Whether you can practically shorten this timeframe or not, it’s important to at least be aware of this. Why? Because psychologically, being able to at least see a shorter distance between effort and output makes the whole activity a lot more manageable.

For instance, if you have a salesman who sells something today and the invoice is paid next week, that’s far easier to manage. Compare that to being in the construction industry; your P&L might show great profits today, but without investing time in selling for down the track, your business could be struggling in 12 months.

It’s about being disciplined today to put effort into selling, ensuring sustainability not just now but in the long run.

Key Takeaway: Mastering the effort-output timeframe starts with being aware of the distance between the two. It’s crucial to be mindful of how long it will take for any efforts will pay off long, and not to neglect your current sales processes.

Mastering Effort & Output for Financial Success

To fine-tune the effort-output equation in your business, here are four key actions to take.

1. Quantify the Timeframe

First, what is the gap between effort (trying to win work) and output (invoicing the client)? Figure out how long it takes from working on a project to getting paid. Most ERP systems can help with this. It might take some setup in your system or data analysis, but your ERP should be able to show you the average time between receiving an order and sending the invoice.

2. Monitor Sales Orders vs. Breakeven

Next, keep a close eye on your sales compared to what it takes to cover your costs. Look ahead for the next six or 12 months, and see how much you’ve got lined up in sales versus your breakeven.

This becomes more crucial if there’s a larger gap between your effort and the results. For the owner of that pizza business, for example, it might not be practical to projects sales three months out. But they have the benefit of more levers to pull that can have a quicker impact on their business. It’s different for an owner of a construction business, however.

In short, knowing your upcoming opportunities and your future breakeven requirements now will help your chances of long-term success.

3. Shorten the Effort-Output Gap

Now, let’s close the loop on one of the considerations we mentioned earlier – reducing the timeframe between effort and output. What are the practical steps you can take to speed things up between your hard work and the outcomes your business needs?

4. Be Consistent & Disciplined

Finally, it’s all about being disciplined and consistent in your efforts. Whether you have great or tough months, staying disciplined pays off in the long run; the overall trend of your performance should be heading upward. Stick to the plan, and you’ll see positive results over time.

Key Takeaway: Businesses can take specific actions to fine-tune their effort-output equation. Quantify the time it takes between effort and invoicing, consistently monitor sales orders against your breakeven, and maintain a disciplined approach to ensure an overall positive performance trend.

Learn everything we teach our clients, free

Join 400+ business owners & leaders who receive practical business & accounting tips, delivered free to your inbox every week. No fluff, just high-level expertise. Sign up now.

.png?width=352&name=Yellow%20Black%20Modern%20Course%20YouTube%20Thumbnail%20(14).png)