The Revenue Myth: Why Sales Won't Fix Everything

In business it’s commonplace to hold the belief that “more sales will fix everything”. This is one of the biggest misnomers we often hear from business owners, who will emphatically claim they just need to bring in more business and that will take care of everything.

While that can be true, there are times when increased revenue isn’t the silver bullet it’s made out to be. There can even be pitfalls associated with chasing more money if you haven’t considered certain financial factors.

The attitude that sales is a cure-all is like driving straight towards a tree and putting your foot down on the accelerator instead of braking or swerving away. Not the smartest choice.

Here’s the reality: Sales, regardless of volume, are not going to fix your business if you don’t understand the deeper reasons behind why your business needs more revenue.

In this article, we explore why it’s wise to hit the brakes on the idea of making more money, and two key factors to look at instead.

Why More Sales Isn’t Always the Answer

If your business is facing challenges, it’s crucial to pinpoint what the real problem is.

There are all sorts of different problems you may be facing, but most often, it boils down to one of two things: not making enough profit or not generating enough cash flow.

Problem #1: Profitability

Let’s look at the profit piece of the puzzle first.

If your business isn’t making enough profit or if it’s losing money, you might be wondering: how on earth can getting more sales not be a good thing?

Increasing revenue can sound like a great idea, but before you step on the gas, there are a few things to consider.

- How much extra revenue are we talking about, and over what period of time?

- What is the gross profit margin on the extra work that will add?

- What extra costs do you need to incur to support that additional revenue being generated?

This information should be laid out in a financial forecast that answers these.

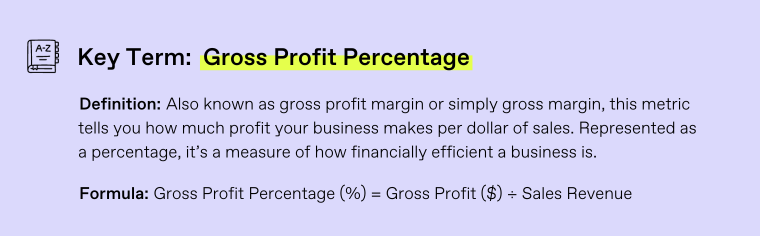

To help answer the second question, as a refresher, gross profit is your revenue minus direct costs of goods sold, measured in dollars. Gross profit percentage is that gross profit dollar value divided by your revenue.

To know if your gross profit percentage on any potential revenue opportunity is worthwhile or not, here are the broad benchmarks we provide our clients.

Gross Profit Percentage Benchmarks

- >10% GP = Excellent. If your gross profit on the new work you’re going to generate is 10 percent or higher than what your current gross profit is, there’s a great chance this is going to be excellent revenue for your business.

- 5-10% GP = Strong. If it’s between five and 10 percent, we would call that good to great. There is a high probability that’s going to be good revenue for your business.

- <5% = Average. If the new revenue being added has only got a gross profit of only five percent more than current levels, you need to tread carefully. There’s still a good chance it’s going to be better for your business. But if any extra revenue is at the same gross profit you’re currently achieving or lower, you need to really understand the consequences it will have for your business.

For the third element of your financial forecast – extra support – this is where you refer to overhead line of your profit and loss statement. This allows you to consider if you can afford the associated costs required due to the additional revenue, such as an extra sales person, location or resources.

For instance, if a new opportunity is slated to add $200,000 in revenue, but you’d need to add $125,000 worth of support, that might not be a worthwhile solution for your business; the new revenue could be coming to you in an unprofitable way.

That’s why a financial forecast is so important. Compared with your current profit levels, if you added new opportunities, what does that mean for your future profitability?

Your accountant or CFO, whether part of your team or external, helps answer these questions. It’s their job to assemble the numbers, and your responsibility to share the story and assumptions around that profitability. That way, you can understand what trajectory your business is on from a profitability perspective, and whether that revenue is beneficial to begin with.

Problem #2: Cash Flow

By now you’ve figured out how more money might affect your profit, but that’s only one side of the story. Now it’s time to look at how more sales would affect your money flow, or how cash comes in and goes out of your business. Working together, you can decide if increased revenue is what your business really needs. Balancing both is essential; if your business is profitable but lacks cash, you’re in a challenging situation.

To ensure a healthy cash buffer, the biggest factor that drives cash flow in a privately owned business is working capital management.

This requires carefully managing the gap between your gross profit percentage and your working capital percentage.

While working capital is a dollar value that refers to the difference between your current assets (anything your business owns) and its current liabilities (any bills or debt that you haven’t paid yet), working capital percentage is this dollar value divided by your annual revenue.

-3.png?width=760&height=320&name=CFOD%20Blog%20Graphics%20-%20Takeaways%20%26%20Actions%20-%203%20lines%20(760%20x%20220%20px)-3.png)

To maximise healthy working capital management, the goal is the biggest gap possible between gross profit percentage (GP%) and working capital percentage (WC%), with GP% being the higher of the two numbers.

Working Capital Management Benchmarks

When it comes to the difference between your GP% and WC%, the magic number we aim for is 15% and above for healthy cash flow.

- >15% = Excellent. If you have a gross profit percentage of 45% and a working capital percentage of 30%, for example, your business will have strong cash flow – as long as it’s profitable.

- 10-15% = Very good. If you’ve got a gap between 10 and 15 percent, you will do quite well.

- 5-10% = Good. If your gap is between five and 10 percent, you’ll still be on track.

- <5% = Difficult. If you’re at 5% and below, however, that’s where things start to get really hard.

If your gap is in the negatives – below 0% – you’re in that revenue category of driving not just towards a tree, but straight off a cliff. That needs to be remedied straight away, in conjunction with your CFO or accountant.

Conclusion

As a business owner or leader, success isn’t just about sales – it’s about making the right moves that ensure lasting growth and stability. Increased revenue is excellent when it’s the right kind of revenue that keeps your key financial metrics – namely gross profit percentage and working capital percentage – in good shape. So before you speed up, make sure you’re not headed straight for that metaphorical tree. Ultimately, business success comes from more than just sales; it’s about balancing profit, money flow, and growing smartly.

Learn everything we teach our clients, free

Join 400+ business owners & leaders who receive practical business & accounting tips, delivered free to your inbox every week. No fluff, just high-level expertise. Sign up now.