Why Trader Joe’s Pays C.O.D — And Why Smart Businesses Should Care

If you’ve ever travelled through the US, you’ve probably stumbled into a Trader Joe’s. It’s the cult-status grocery chain with Hawaiian shirts, quirky product labels, and a legion of die-hard fans.

But behind the fun branding is one of the most quietly brilliant financial strategies in modern retail: Trader Joe’s pays its suppliers C.O.D — cash on delivery.

Yep. A supermarket chain doing over US$20 billion a year in revenue… paying suppliers immediately.

Meanwhile in Australia, we’ve got Coles and Woolies stretching suppliers out to 60–90 days like it’s an Olympic sport.

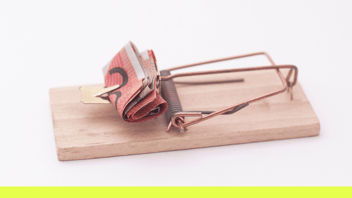

So why on earth would a massive US retailer voluntarily pay faster than anyone expects? Is it generosity? Is it naïve? Or is it one of the smartest working-capital plays of all time?

Let’s break it down.

→ First: Why C.O.D Makes Zero Sense… Until You Look Closer

→ The Real Reason Trader Joe’s Pays C.O.D

→ The Three Leverage Points Trader Joe’s Unlocks

→ Is Trader Joe’s Just Being Generous?

→ What Your Business Can Steal From Trader Joe’s

→ The Bottom Line

→ How CFO Dynamics Helps Businesses Transform Supplier Relationships & Cashflow

First: Why C.O.D Makes Zero Sense… Until You Look Closer

On the surface, paying C.O.D looks like bad business. When you're that big, you’d think:

- You have leverage

- You can negotiate whatever terms you want

- You can push suppliers out to 30, 60, 90 days

- You’d want to keep your cash in your bank account as long as possible

But Trader Joe’s flips the script. And the results are game-changing.

While they’ve never officially disclosed why they do it, there’s enough evidence — and enough economic logic — to piece together the strategy.

Here’s the hypothesis (and where the magic happens).

The Real Reason Trader Joe’s Pays C.O.D

When you pay a supplier faster than they expect, you instantly become their favourite customer. Not because you’re big, not because you’re nice — but because you fundamentally de-risk their business.

Think about it from the supplier’s perspective:

- Most retailers take 30–90 days to pay

- Cashflow becomes a permanent point of anxiety

- Margins shrink while they wait

- Debt creeps up

- Risk sits entirely on the supplier

Now picture the opposite.

A customer willing to pay the moment the product arrives.

Suddenly you’re not just a buyer — you’re a dream.

And dream clients get different treatment.

The Three Leverage Points Trader Joe’s Unlocks

1. Better Pricing

Cash on delivery is worth serious money to a supplier. It removes uncertainty, improves their working capital, and reduces their borrowing costs.

So what are they willing to trade in return?

A better price.

Which means Trader Joe’s can either:

-

Pass the saving on to customers (which creates insane loyalty), or

-

Pocket it as margin (which strengthens the entire business), or

-

Do a bit of both

This is competitive advantage 101.

2. Faster Stock Turns (This Is the Silent Killer Benefit)

When suppliers love you, they do things they don’t do for everyone else — like offering:

- Smaller, more frequent deliveries

- Priority Packing

- Flexible quantities

- Reduced minimum order requirements

- Risk sits entirely on the supplier

Why does that matter?

Because it means Trader Joe’s doesn’t need to hold massive stock volumes.

Less stock =

- Less working capital tied up

- Lower spoilage risk

- Faster rotation

- Better freshness

- More responsiveness to customer demand

This is how they maintain that “everything feels fresh and replenished constantly” vibe their customers rave about.

3. A Differentiated Supplier Relationship

Most retailers treat suppliers like necessary evils.

Trader Joe’s treats them like strategic partners.

Paying C.O.D isn’t an act of kindness — but it is a signal:

“We value you. We’re not here to squeeze you. We’re here to grow with you.”

That kind of relationship buys goodwill you can’t negotiate with contracts.

And goodwill, over time, becomes leverage.

Is Trader Joe’s Just Being Generous?

Short answer: no.

Long answer: Sort of… but only because generosity is profitable when used strategically.

Could they get most of these benefits paying in 7 or 14 days instead of C.O.D? Probably.

But C.O.D sends a clean, powerful message:

“We’re the easiest customer you’ll ever deal with.”

You don’t get stuck waiting.

You don’t get strung out.

You know your cashflow the second product leaves your warehouse.

And when you’re a supplier choosing between sending your limited stock to Trader Joe’s or to a retailer that pays in 90 days… you choose Trader Joe’s every time.

This is how the brand keeps consistently high-quality, exclusive, fan-favourite products on shelves.

What Your Business Can Steal From Trader Joe’s

No, you don’t need to start paying C.O.D tomorrow.

But you should ask:

1. “What would make me a truly A-grade client to my suppliers?”

Because when you’re an A-grade client, suppliers will bend for you.

2. “Could I negotiate better pricing or terms by paying slightly faster?”

Try this script:

“You currently offer 30-day terms. What discount would you allow if we paid in 7 days?”

“What if we paid on delivery?”

Even 1–3% improvement on cost of goods can be worth six or seven figures annually.

3. “Can I reduce stockholding by ordering more frequently?”

Sometimes the difference between slow and fast stock turns is simply:

- Better supplier relationships

- More trust

- More flexibility in ordering

4. “Am I squeezing suppliers so tightly that I’ve restricted my own options?”

A supplier who feels strangled isn’t going to innovate for you.

A supplier who feels supported will call you first when opportunities arise.

Your terms impact far more than payments — they impact your competitive moat.

The Bottom Line

Trader Joe’s paying C.O.D looks counterintuitive.

But the strategy is razor-sharp:

- Lower supplier risk = better pricing

- Better pricing = stronger margin or cheaper retail price

- Faster deliveries = lower inventory

- Lower inventory = stronger cashflow

- Stronger cashflow + better relationships = long-term advantage

It’s not charity.

It’s not naïve.

It’s not inefficient.

It’s the kind of financial thinking that separates great businesses from average ones.

And for your business, the question isn’t:

“Should we pay C.O.D?”

It’s:

“What could we gain if our suppliers saw us as their favourite customer?”

Because as always —

It’s not just about keeping the money in your pocket.

It’s about spending the money in the right places so you can create even more tomorrow.

How CFO Dynamics Helps Businesses Transform Supplier Relationships & Cashflow

Understanding why Trader Joe’s wins is one thing.

But applying those principles inside your business — with your suppliers, your cash constraints, your pricing model, and your operational quirks — is a completely different challenge.

This is where CFO Dynamics steps in.

Most businesses either:

- Pay suppliers later because cashflow is tight

- Pay on time but don't negotiate anything in return

- Have no structured supplier strategy at all

We fix that.

1. We analyse your supplier terms and identify hidden leverage points

Every supplier relationship has untapped opportunity — better pricing, shorter minimum orders, faster delivery cycles, or improved rebates.

We help you find them, quantify them, and negotiate them.

2. We build a working capital strategy based on your operating model

Not every business should pay C.O.D.

But every business should understand the financial impact of paying earlier, later, or differently.

We model scenarios such as:

- What discount should you demand for paying in 7 days?

- What's the ROI of reducing stock by 20%?

- How does changing supplier terms shift your cashflow curve?

This turns vague ideas into clear, confident decisions.

3. We help you become an A-grade client (without giving away margin)

You don’t need to overpay to be a preferred customer.

Instead, we help you structure the relationship so suppliers are excited to work with you — and willing to offer more competitive terms in return.

That might look like:

- Smarter ordering patterns

- Committing to consistent volumes

- Improving your payment predictability

- Negotiating creative win-win terms (It's rarely just 'pay faster.')

Most businesses treat supplier terms as a static line item.

At CFO Dynamics, we teach you how to turn them into a weapon — lowering inventory, improving margins, strengthening cashflow, and unlocking faster growth.

Exactly like Trader Joe’s has done for decades.

Subscribe to our newsletter

For more tips on increasing revenue and profitability, sign up to our newsletter for business owners, leaders, and finance team managers. Each week, you'll get practical, no-fluff tips and insights in short, easy videos. No corporate jargon, no time wasting. Sign up now.