Working Capital Explained Simply

What is Working Capital?

Working capital the difference between current assets and current liabilities. It serves as a benchmark to gauge a business's cash requirements for growth and day-to-day operations.

It represents how easily your business can cover its short-term expenses and obligations, shows how efficiently it operates, and gives a snapshot of your current financial health.

It's important because it helps you understand how much cash your business needs for growth. The lower your working capital percentage (also known as working capital ratio), the less cash your business needs to grow. The higher it is, the more challenging it will be to fund growth. The bigger the gap between your working capital percentage and gross profit percentage, the easier it is for your business to grow.

In this article:

→ Working capital summarised in 5 sentences

→ Working capital explained simply

→ How to calculate working capital

→ Why is GP such is a crucial number?

→ The exact gross profit benchmark to aim for

→ Factors that influence working capital

In Short: Working Capital

- Working capital is crucial for understanding a business's cash needs.

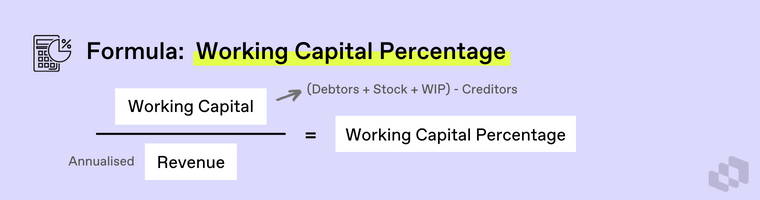

- To calculate working capital, sum your debtors plus your stock plus your work in progress (if you have any), minus your creditors.

- The ideal working capital percentage varies by industry but generally should be 20% or lower. This ensures sufficient liquidity while maintaining good relationships with suppliers.

- Factors that influence working capital include debtor management, stock levels and creditor terms.

- Businesses can influence working capital by handling the money owed to them wisely, optimising how much stock they keep on hand, and maintaining a balance with the terms they have with their suppliers.

Working Capital Explained Simply

Working capital is your debtors plus your stock, plus your work in progress if you have any, minus your creditors equals working capital. Working capital percentage is looking at your working capital divided by your annualised revenue to give you a percentage of how much working capital you'll need versus the revenue that you are producing.

“Working capital is your debtors plus your stock, plus your work in progress if you have any, minus your creditors.

Working capital percentage is looking at your working capital divided by your annualised revenue to give you a percentage of how much working capital you'll need versus the revenue that you are producing.

Why is working capital important?

The reason this number is so important is this is going to be a benchmark to understand how much cash your business needs to grow. The lower your working capital percentage, the less cash your business will need to grow.

Working capital benchmarks to aim for

What we aim for from a working capital perspective will be different in industry and by business, but as a broad benchmark, you ideally want your working capital percentage to be 20% and below while still keeping a good relationship with your suppliers.

To use an example like a supermarket that's very large in nature, they'll have no debtors. They'll have relatively small stock in comparison to their days' creditors. That means that they'll end up with a negative working capital percentage, but despite all their commercials, they probably don't have a great relationship with their suppliers.

For us, in the privately owned business sphere, it's important to have good relationships with our suppliers, hence having that working capital percentage, we ideally want it 20% and below. If we've got our working capital percentage at 25% and above, that is when things become more challenging from a funding our growth perspective.

The metric around working capital versus gross profit is going to be a key factor in our growth. The bigger the gap between the gross profit percentage and the working capital percentage, the easier it is for our business to grow, where we want gross profit to be the higher of those two numbers.

How do you influence working capital?

Let's look at all the different factors. Firstly, debtors, the people who we've sold to on credit that owe us money, the quicker that we can get them to pay us or even get deposits from people, that reduces our debtor obligations.

Moving to our stock and our work in progress. How do we manage our stock so that we can use the Goldilocks principle of having just the right amount of stock to meet demand, but not too much of an impost on our cash?

Also, balancing our creditors. We want to keep our creditors managed so that if someone gives us terms, we utilise those terms. There's a whole lot of theory that goes into looking after your suppliers, which I completely agree with, but for this video, we'll assume we pay them on their terms.

What influences working capital percentage?

Then to influence the percentage: further to those factors we just talked about is how do I increase my revenue? How can I increase my revenue at a disproportionate rate to what I increase my working capital? If I can increase my revenue by 20%, but only increase my working capital by 10%, that is a winning equation for this formula and for my business.

Learn everything we teach our clients... for free

Join 400+ business owners & leaders who receive practical business & accounting tips, delivered free to your inbox every week. No fluff, just high-level expertise. Sign up now.

.png?width=352&name=Yellow%20Black%20Modern%20Course%20YouTube%20Thumbnail%20(39).png)